The latest release of the FinancialForce suite also strengthens predictable services capabilities in their PSA offering, and further improves forecasting with additional Salesforce Einstein integration.

Cloud ERP vendor FinancialForce has announced their Spring 2018 release, which delivers enhancements across their product portfolio suite. FinancialForce has a close relationship with CRM giant Salesforce, but is a separate company independent of it. Their products are all natively built on the Salesforce platform, with their main product portfolios being Professional Services Automation (PSA), which helps services organizations to run their businesses with greater predictability, and Billing Central, their subscription and usage billing management solution. FinancialForce is stressing that this release deepens their ability to deliver more of an ‘everything-as-a-service’ business model.

Cloud ERP vendor FinancialForce has announced their Spring 2018 release, which delivers enhancements across their product portfolio suite. FinancialForce has a close relationship with CRM giant Salesforce, but is a separate company independent of it. Their products are all natively built on the Salesforce platform, with their main product portfolios being Professional Services Automation (PSA), which helps services organizations to run their businesses with greater predictability, and Billing Central, their subscription and usage billing management solution. FinancialForce is stressing that this release deepens their ability to deliver more of an ‘everything-as-a-service’ business model.

David Krauss, Global Solutions Evangelist at FinancialForce, highlighted multiple ways in which the spring release brings enhanced focus to the philosophies which have always been at the core of FinancialForce’s raison d’etre.

“First, we are helping customers make the shift to the ‘everything-as-a-service’ business model,” he said. “Our goal is to enable customers to deliver all their products-as-a-service in a unified way, and provide a more personalized and consistent pricing experience, even when requiring complex calculations. Ultimately, an experience as individualized as Amazon provides is the goal. Our latest release of Billing Central is all about personalizing around pricing and billing.”

The new release lets Billing Central users deploy various, complex-charge models with greater speed and configurability, as well as automate complex proration calculations when subscription services are added mid-term.

The spring release also integrates Billing Central to Salesforce’s CPQ [Configure Price Quote].

“We’ve seen some good traction there,” Krauss said

“There is also a version of Salesforce Community for financial management, and the spring release enables customers to put their subscriptions and usage-based invoices in the FinancialForce Financial Management Community,” Krauss said. Through this self-serve portal, customers can view and manage these subscriptions and usage-based services, across multiple contracts and services.

“That adds to the self-service experience, and is a further shift to the ‘everything as a service’ business model,” Krauss said.

The second objective in the release is to help customers attain a more predictable services business. To this end, FinancialForce PSA adds new resource optimization capabilities, to reduce the time to value in a project. Actionable, 360-degree visibility across sales pipeline and unscheduled backlog based on actual delivery schedules has also been added.

“The predicable services delivery theme is important,” Krauss stated. “We wanted to use real-time opportunity sales data to be more predictable. In this release, we have improved the way planners can assign resources to products, and improved advanced filtering capabilities.”

The new release also expands shift management capabilities for customers with managed services in their portfolio or with technical services, where they have a repeated shift requirement. It lets planners quickly find and assign best-fit resources with enhanced skills filtering, tailored color coding, and advanced search capabilities.

“It provides a more templated experience,” Krauss said.

“We have also partnered with ADP for core HR capabilities,” he noted. “The integration helps onboard resources faster.” Using a standard based API integration, managers can now create a PSA resource using ADP or their core HR system of record to onboard services resources faster and keep data consistent.

The third theme in the release is delivering more powerful forecasting, using the capabilities of the Salesforce Einstein AI, which Salesforce introduced in the fall of 2016, and which the close relationship between the two companies enables FinancialForce to leverage.

“We are driven by our commitment to Salesforce Einstein,” Krauss said. “We aren’t there yet in terms of embedding it, but we are laying the groundwork. We run our own entire business on Einstein. Prior to Einstein, what we wanted to do in terms of harnessing big data wasn’t previously possible. Einstein analytics will allow us to process things in a very cost-effective way.

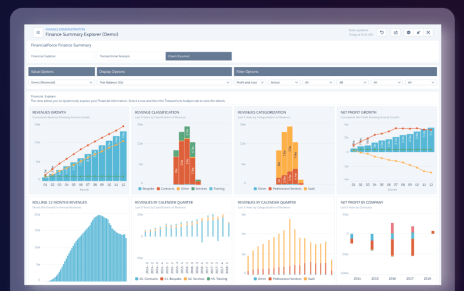

“In the spring release, we have done a couple of things to improve forecasting,” Krauss indicated. “On the PSA side, we now connect sales backlog information, unifying product and opportunity forecasts in a more granular way. You can drill down by business units and compare multiple forecast scenarios.”

This first iteration powered by Einstein includes large data reports.

“Einstein Ready Financial Reporting allows customers to use the Salesforce analytics in-memory platform with our financial management applications,” Krauss said. “We will be announcing some more capabilities here in the fall.”

Krauss said that while the heavy lifting work on the engine side has been done, the power of being able to process large amounts of data is something that they are still working on.

“Integrating the analytics is more of an operational challenge,” he explained. “We are able to demo it beautifully, and we have run some pilots, but it is not currently something that we offer out of the box.”