Canadian organizations are progressing fairly slowly at the higher levels of digital adaptation, but there has been significant movement from the less advanced ranks, and compared to global numbers being released today, the Canadian numbers released last fall look better in comparison.

Last October, a new study conducted by Vanson Bourne on behalf of Dell Technologies and Intel released the Canadian data in a Digital Transformation Index they conducted. The study was a follow-up to a similar one conducted in 2016. When that Canadian data was released the aggregated global numbers were held back, and have been released now. The new data are likely to change impressions of Canadian performance somewhat. In October, the sole basis for comparison was the 2016 study, which showed a limited improvement. The new data however, indicate that Canada did pretty well compared to global competitors. While Canadian companies didn’t post bleeding edge performance, they had solid middle-of-the pack numbers, which make it hard to conclude Canada is a laggard here.

Last October, a new study conducted by Vanson Bourne on behalf of Dell Technologies and Intel released the Canadian data in a Digital Transformation Index they conducted. The study was a follow-up to a similar one conducted in 2016. When that Canadian data was released the aggregated global numbers were held back, and have been released now. The new data are likely to change impressions of Canadian performance somewhat. In October, the sole basis for comparison was the 2016 study, which showed a limited improvement. The new data however, indicate that Canada did pretty well compared to global competitors. While Canadian companies didn’t post bleeding edge performance, they had solid middle-of-the pack numbers, which make it hard to conclude Canada is a laggard here.

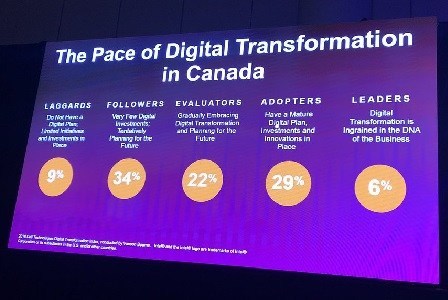

The study surveyed 4,600 business leaders from mid- to large-size companies across 42 countries, to measure their place on the Dell Technologies Digital Transformation Index. That Index measures the extent of their digital transformation efforts by examining their IT strategy, workforce transformation initiatives and perceived performance against a core set of digital business attributes. The data was generally self-reported by the participants. The companies were then grouped into four groups:

Digital leaders are at the top of the pyramid with transformation ingrained in their DNA. Globally this was 5 per cent of companies. It was 6 per cent in Canada, up from 3 per cent in 2016.

The second group, Digital Adopters, have a mature digital plan, and investments and innovations in place. Globally this was 23 per cent of respondents. In Canada, it was 29 per cent, up from 12 per cent last time.

The third group, Digital Evaluators, is gradually embracing digital transformation, and planning and investing for the future. Globally, this was the largest group, at 33 per cent. In Canada, it was 22 per cent, down from 24 per cent in 2016.

The bottom group, Digital Followers, have made very few digital investments and are tentatively starting to make plans. The one real fly in the ointment for Canada in the context of these global numbers was this category, where the Canadian total of 34 per cent was above the global total of 30 per cent, although it was an improvement on the 44 per cent Canada posted in 2016.

“We’ve made some progress, and there are still challenges, but we at least understand the changes that have to be made,” said Danny Cobb, Dell Technologies Corporate Fellow – VP, Global Technology Strategy. “When you look at industries and geos and where we are in an absolute sense, it doesn’t feel so bad, especially when you consider how rapidly the transformation and disruption are coming.”

The fact that only 6 per cent of Canadian leaders are in the top category, given the emphasis on digital transformation over the last two years, was a little perplexing to Cobb.

“I was surprised that there we’re not seeing more progress in the digital leader category, especially given the work on human-machine partnerships and the impact of this next generation, Generation Z, flowing into the workforce,” he said. “The comparative data do not indicate that Canada is a laggard though when compared to other geos. Canadian companies are seldom on the cutting edge. The culture that I see when I talk with Canadian customers isn’t one that is ready to rush willy-nilly to the latest bright shiny thing. It’s more about thoughtful polite inspection of the facts. It seems very unCanadian to go out there and disrupt. But while Canada isn’t a disruptor, compared to others, it isn’t behind either.”

Cobb sees the more significant part of these data to be the lower parts of the pyramid, where there has been movement since 2016.

“The technology factors have begun to redraw the business landscape, creating a new set of opportunities and risks, and people are beginning to engage,” he said. “That’s palpable. The data in 2016 showed that and we have moved further down that path. Because the data is self-reported, I think some of the lag reflects the fact that a lot of those programs are still in their infancy. People who expected themselves to be further along two years ago are still in same place. That’s why the digital leaders hasn’t moved much. But there is movement out of the laggards area. There is execution. Movement is beginning to happen. People are beginning to understand the difference between a laggard and a leader – things like a willingness to reskill the workforce to be more datacentric. We are seeing actions that can be talking at the Board of Directors level, the management level, and the individual contributor level to get things moving more rapidly.”

These things are reflected in other elements of the data. Only 21 per cent of Canadian businesses believe they will struggle to meet changing customer demands within five years – far below the global average of 51 per cent. In addition, 83 per cent of Canadian businesses believe that digital transformation should be more widespread throughout the organization, more than the global average of 78 per cent.

So what are the key takeaways here for customers?

“We have seen tremendous progress made in applying best practices in artificial intelligence and machine learning around speech, sight and risk management,” Cobb said. “Two years ago, we began to collect a lot more data. Now we are using it to train and make better predictions. Multi-cloud is becoming the dominant paradigm. It’s not just that things move to a cloud – it’s that certain clouds will be external, and some of those will be good at AI and ML , some for archiving and long term compliance and some for development. Things are also increasingly impacted by rapid advancement in compute technology, and in media technology with flash, and cybersecurity is ever more present. Increasingly, more of customers’ investments will be on the digital disruption side. But that means that their ‘keeping the lights on investments need to be more efficient, so businesses can afford budget for a more digital-native world.” That could be a concern for some Canadian customers. Lack of budget and resources, which ranked as the second most significant barrier to digital transformation globally, topped the list in Canada.

For the channel, they have a key role in translating all of this into language their customers best understand.

“They are an invaluable resource in this sort of environment, where there are new technologies becoming available,” Cobb said. “They translate the abstract value propositions of technology into specific solutions that meets customer needs, and play a very important role making sure there is a fit.”